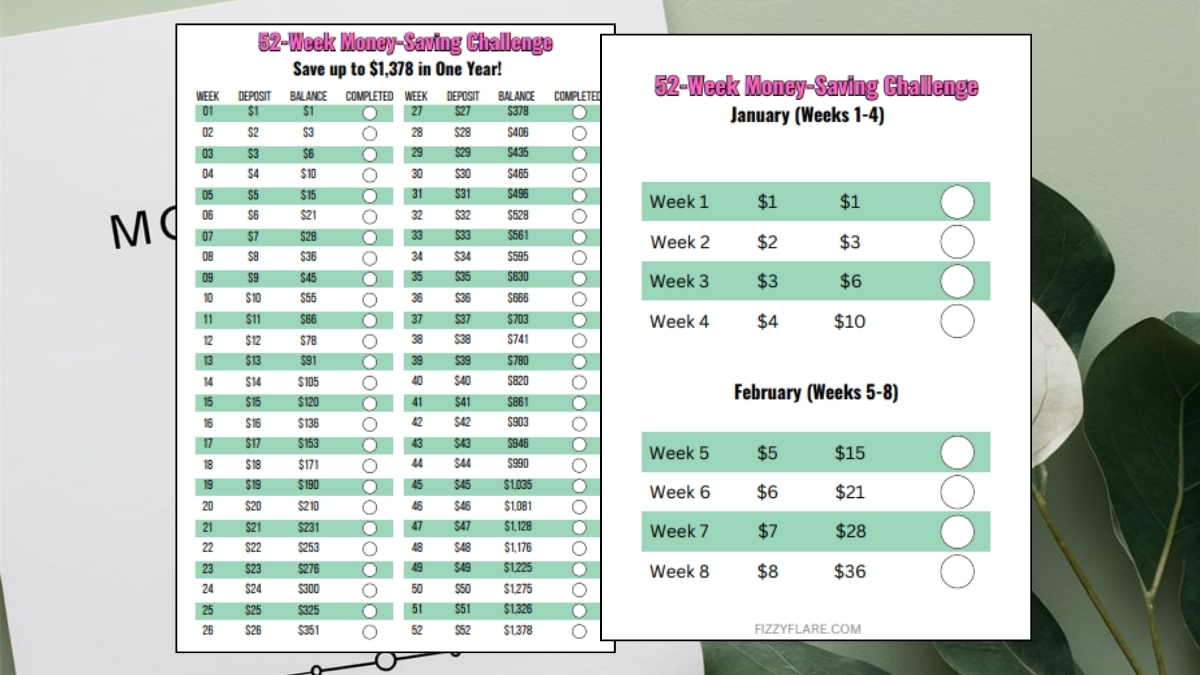

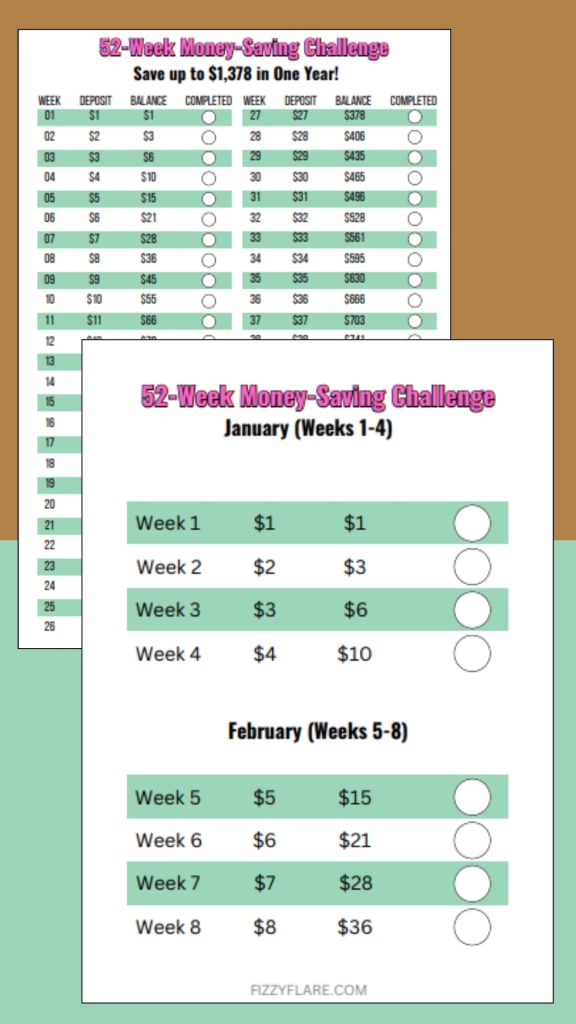

52 Week Money Saving Challenge for 2025

The 52 Week Money Saving Challenge is a fun and effective way to build your savings over the course of a year.

Each week, you set aside a specific amount of money, starting with just one dollar in the first week.

As the weeks progress, you gradually increase the amount you save, making it easier to reach your financial goals.

Let’s deep dive!

What Is 52 Weeks Money Saving Challenge?

Each week, you set aside a specific amount of money that increases as the weeks go by.

For example, in the first week, you save $1, in the second week, you save $2, and so on, until the last week of the year, when you save $52.

By the end of the year, if you follow this plan, you will have saved a total of $1,378.

This challenge helps you build savings gradually and can be a great way to prepare for a special purchase or to build an emergency fund.

It’s easy to do and can lead to financial success with just a small amount of effort each week.

Benefits of 52 Week Saving Challenge?

Firstly, it encourages consistency in saving by breaking down the goal into manageable weekly amounts, making it easier to stick to the plan.

By the end of the year, you can save a substantial amount, often exceeding $1,300, which can be a significant boost for an emergency fund, a vacation, or paying off debts.

Moreover, this challenge helps instill discipline and awareness of your spending patterns, promoting better budgeting skills over time.

It can also provide a sense of accomplishment as you see your savings grow week by week, motivating you to continue saving.

How to Start a 52 Weeks Saving Challenge?

You should first, download our printable sheet for 52 weeks challenge. Begin by setting aside a specific amount of money each week.

The goal is to save an increasing amount each week, starting with just $1 in the first week, then $2 in the second week, and so on, until you reach $52 in the final week.

By the end of the year, you will have saved a total of $1,378. Each week, place your savings in a designated spot.

Be sure to stick to your plan, and don’t hesitate to adjust the amounts if needed to suit your budget.

Fasial is the founder of the Fizzy Flare. He has been a passionate blogger since 2021. He ran three different websites in the past few years. Now he is focusing on Fizzy Flare to build an audience and help them organize their life.